About Odos

Odos is a smart order routing solution that uses a sophisticated optimization algorithm to unify fragmented liquidity and maximize the output of every trade. As order routing drives all digital asset transactions and DeFi growth, Odos stands at the forefront—providing top-tier infrastructure for both retail users and those building on it.

How Odos Delivers Value

Decentralized finance is complex and fragmented, but Odos simplifies it through innovation, efficiency, and seamless integrations. Here’s how:

- Advanced Order Routing: Odos harnesses a powerful optimization algorithm to deliver maximum output on every swap. With order types like Simple Swap, Advanced Market Orders, and Limit Orders, traders gain unmatched flexibility and control.

- Comprehensive Liquidity Integration: By continuously integrating and prioritizing relevant, high-speed liquidity sources—spanning 1050+ pools and 15 chains—Odos provides expansive coverage for a wide range of assets, including yield-bearing tokens.

- Robust APIs for Growth: From free to soon-to-be-offered enterprise plans, Odos APIs enable partners to build new products, streamline services, and tap into DeFi’s full potential.

- Versatile Product Suite: Token Pricing for 100,000+ DeFi assets, Zaps for effortless liquidity provisioning, and multi-token input/output solutions equip both traders and treasury managers with advanced, yet accessible, tools.

- Responsive Collaboration: Our development team is readily available to support integrations, customize offerings, and drive innovation alongside partners.

For traders, Odos delivers better outcomes with fewer steps. For developers and integrators, it’s an essential partner for unlocking advanced DeFi capabilities.

For traders, Odos delivers better outcomes with fewer steps. For developers and integrators, it’s an essential partner for unlocking advanced DeFi capabilities.

Why should I use Odos instead of a single DEX?

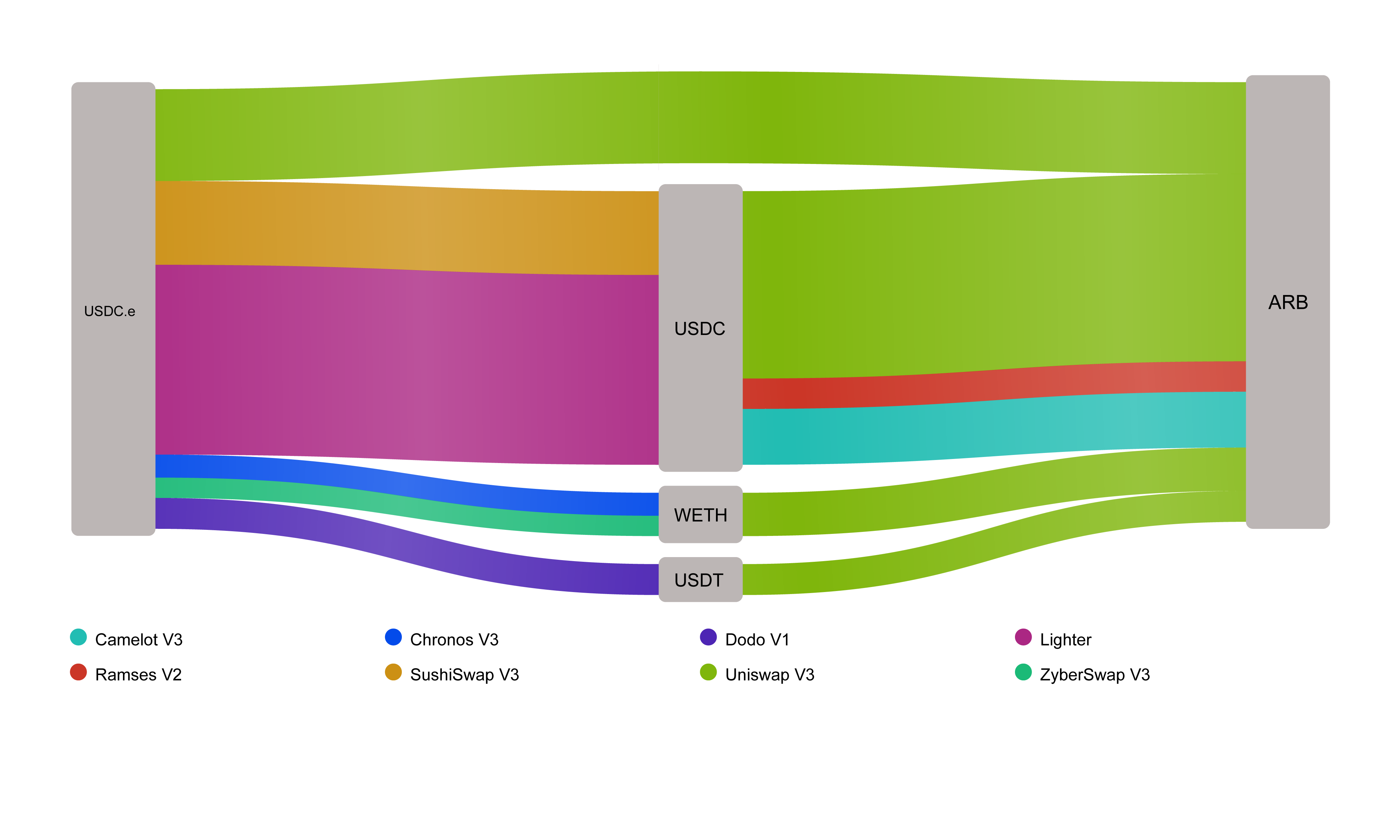

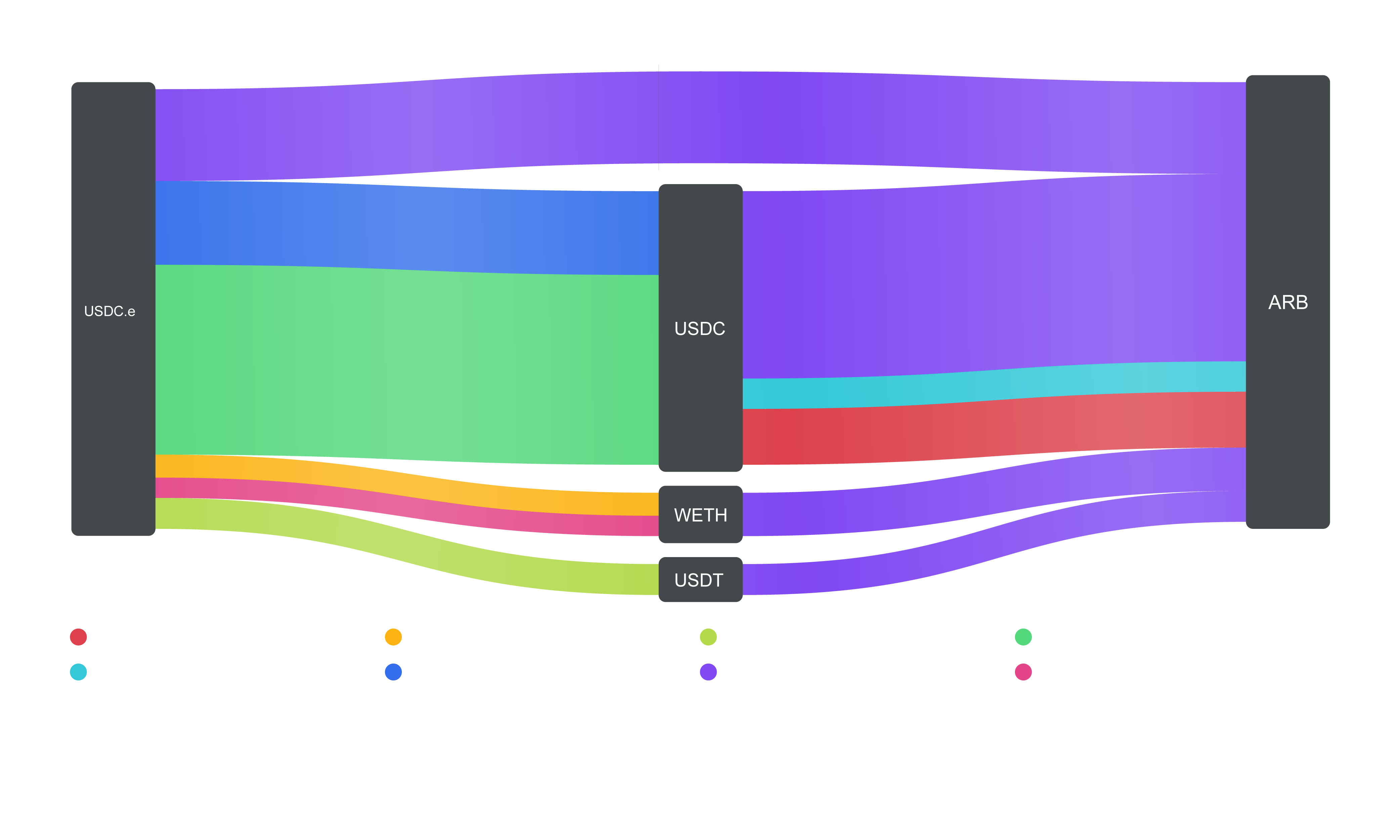

Using a DEX aggregator can save you time and potentially reduce costs. Instead of manually checking prices across multiple DEXs, Odos does it for you. We identify the best price across the various DEXs and execute trades at the most favorable rates, oftentimes splitting the trade amount over many different pools and intermediate tokens in order to get the most output value for the user net of gas.

How does Odos ensure safety of transactions?

We don't hold user funds and our contracts have been audited. The safety of your funds when using a DEX aggregator depends on the security measures implemented by the platform. While DEX aggregators don't hold your funds directly, the smart contracts they use to interact with different DEXs hold permissions to spend your funds.

The contracts that users and customers directly interact with have been audited, and reports can be found on the Audits page.

Does Odos use more gas to make swaps?

Odos maximizes value output, which can result in complex paths through DeFi. Odos is a DEX aggregator, giving it the unique advantage of scanning the entire DeFi ecosystem to determine the optimal token swap route, assuring you receive the most favorable rate, even after considering gas costs. This means Odos may occasionally suggest a swap path that uses more gas, but only if it results in a significantly higher quantity of output tokens from the swap.

Additionally, we've integrated Blocknative’s Gas API, which accesses the Mempool for accurate gas quotes, ensuring your transaction enters the next block with the least amount of slippage. This way, Odos ensures that customers are always getting the best possible swap.

What is slippage?

Slippage is the difference between the expected price of a trade and the actual price at which the trade is executed. It occurs due to the changes in the price of an asset between the time of placing a trade and when it's executed. It's especially relevant in markets that are highly volatile, where the price can change rapidly in a short period.

How do I prevent slippage?

Always make sure the minimum amount out of a swap represents an acceptable value to you. To guard against big price changes during a trade, you can set a 'slippage tolerance' in the app's settings. This is your maximum acceptable price change. If the price change is too big, the trade won't happen. If it's within your set limit, the trade goes through. Always double-check the minimum trade value to ensure you're comfortable with the potential trade outcome.

We've partnered with BloxRoute to offer our users MEV-protected endpoints which protect from frontrunning.

| Network | Chain ID | RPC URL |

|---|---|---|

| Ethereum | 1 | https://odos-eth.rpc.blxrbdn.com |

| BNB | 56 | https://odos-bnb.rpc.blxrbdn.com |

Is Odos Open Source?

Partially. The router, which all transactions go through, is Open Source and MIT licensed. Anybody can use the router to execute trades with their own executors, and they will inherit the security of Odos and enforce the minimum received quotes. Refer to the Quick Start Guides to learn how to use it for your own services.

The algorithm we have built to find these paths is patented and closed source. Our data collection is also closed source.

Ready to Dive In?

- Start trading on app.odos.xyz.

- Explore our Quick Start Guides to integrate Odos into your platform.

- Learn how to maximize rewards through the Loyalty Program.